Stock control on refunds is very important. It is split into the following five sections:

1. Product returned for a refund, product faulty.

2. Product returned for a refund, product put back in stock to be resold.

3. Product returned, replacement sent (original faulty)

4. Product returned original fixed and sent back

5. Suggestions for disposing of returned product/

It is important for you or your staff to handle all these situations correctly so that the stock level is maintained. Mistakes can result in overselling (or underselling) as the products are either mistakenly added back to OMINS stock when damaged/faulty and should not be resold.

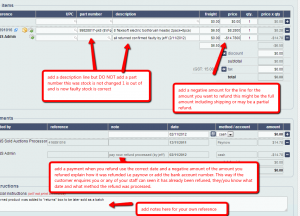

1. Product returned for a refund, product faulty

A product is returned to us and after testing it is found that the product is in fact faulty or not in a condition to resell. We have made the decision to refund the customer and dispose of the product. Here’s how this should be handled:

1. We find the original invoice for this customer.

2. Change the type to refund (read the invoice types guide). This will mean the original product is still using the stock.

3. Add a “miscellaneous” product line to the invoice and give it a meaningful description such as “XYZ product returned, confirmed faulty by jeff”, then add a negative amount for this for the amount you wish to refund the customer.

(Alternatively you can then set the amount of the original product to $0, however you should still add a miscellaneous line to confirm the return of the product and possibly to allow the shipping to be refunded. Putting the original amount to 0 has the benefit of recording no profit (only the product cost) for this sale which is will give you a more accurate profit report if certain products have a high return rate for faulty items.)

4. You might want to add some notes to the bottom regarding testing or what you did with the returned product for your own reference.

5. When the payment has been made, add a negative payment to the invoice for the amount and use the correct date. Comment the payment with the method of refund, i.e PayNow or the bank account number. This way you or your staff will know when and how this was refunded just by inspecting the original order if the customer inquires. This prevents an expensive “double refund” scenario.

6. If done correctly with the refund the balance should be $0. Remember to click save.

Doing this means the original product line with the part number is still out of stock. This is now represented as a faulty item that cannot be resold as new. The customer has been refunded and there is a record on their invoice.

Here is an example of a completed refund invoice for a faulty item that has been returned:

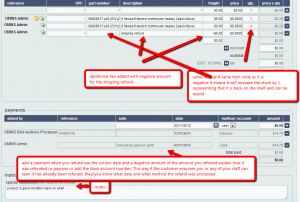

2. Product returned for a refund, product put back in stock to be resold

The customer simply did not like the product. They did not open it and returned it in excellent (or unused) condition so it can be resold and you are going to refund the customer.

1. We find the original invoice for this customer.

2. Change the invoice type to refund (read the invoice types guide). This will mean the original product is still using the stock.

3. Add the same product code but use a negative number for quantity instead of a positive number, i.e. if they returned one add -1 as the quantity. (If they returned more than one, use the quantity they returned in negative. If they returned multiple products, add multiple lines). The amount should be the same. If you wish to refund the shipping, another “miscellaneous” line should be added with a negative amount to match the shipping. (Don’t change the cost of the product to include the shipping refund as it will affect your profit/sales reports.)

4. You might want to add some notes to the bottom regarding testing or what you did with the returned product for your own reference.

5. When the payment has been made, add a negative payment to the invoice for the amount and use the correct date. Comment the payment with the method of refund, i.e PayNow or the bank account number. This way you or your staff will know when and how this was refunded just by inspecting the original order if the customer inquires. This also prevents an expensive “double refund” scenario.

6. If done correctly, with the refund the balance should be $0. Remember to click save.

Here is an example:

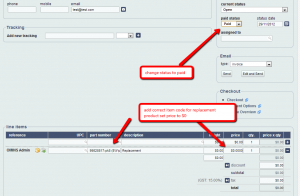

3. Product returned, replacement sent (original faulty)

The customer simply did not like the product. The customer simply did not like the product. They did not open it and returned it in excellent (or unused) condition so it can be resold and you are going to refund the customer.

1. We find the original invoice for this customer.

2. Add a comment to special instructions, something like “{current date} Replacement sent, new invoice for replacement created for customer.” This allows you/other staff to see a replacement was sent for this invoice. Click save.

3. Click on the “go to contact” button on the top of the page.

4. Click on “create new order/invoice”.

5. The address should be automatically populated from the customer’s record on file, but check to make sure that it is correct (i.e. the same as the last invoice or change it if the customer has provided a new one).

6. Add the replacement product, add the exact item code of the replacement item (if it is the same product, use same code. If it is a similar but different product, use that code). Set the price to $0. You can optionally change the description to “replacement” or add something similar to the comments so it is obvious to anyone viewing the invoice that it was created at $0.

7. Set the invoice to paid (this should automatically set the dispatch date).

8. Either print it now and process it or the replacement invoice will show the next time someone runs the “to print and dispatch today” (read the guide on orders to print and dispatch).

Using this method, a new order is created which makes it easy for the warehouse staff to process and add a tracking number which the customer will be informed of and will be easy for you to follow as there is an entry for the replacement.

Also as the real product code is used for the replacement an additional unit is removed from stock. So now for this customer there are 2 items out of stock; 1 on his original invoice (faulty) and one on the replacement invoice, so the stock level is accurate.

In addition, as the price is 0 the cost is recorded for profit reports but no income giving an accurate profit report.

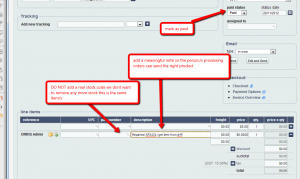

4. Product returned original fixed and sent back

The customer returns a product that is faulty. You are able to fix the fault (or it was not faulty) and will be sending back the same item(s) to the customer.

This is very similar to “product returned, replacement sent (original faulty)”, however at step 6 you do not add a real stock code. Instead add a “miscellaneous” line and add a description there that is meaningful for the person processing the orders. DO NOT use the real stock code because we don’t want an additional item to be removed from stock. We just want a new invoice to track the shipment.

For example:

Suggestions for disposing of the returned product

You may be able to have warranty services on faulty products with your suppliers in which case we suggest either a separate spreadsheet for the supplier (say using Google Docs) to keep track of these. We don’t suggest you attempt to organize anything in OMINS using the real stock codes. This may confuse staff and cause stock problems. Just stick to the style above to ensure the stock is reliable. You should use stock adjustments when repaired/new warranty replacements arrive.

If the warranty is difficult or uneconomical to have serviced and the product requires disposal, suggest you collect in a set and sell them as returned product on $1 reserve or resell individual depending on the value and expected return value of the returned products. Again, keep a list (Google doc) of returned products and reported faults so that it is easy to sell them when required.

This post is also available in: Chinese (Simplified)